Summary: Ahh super. Not a topic close to (most of?) the FIRE purist’s heart. Why? It doesn’t actually help you FIRE any earlier.

Ahh super. Not a topic close to (a lot of?) the FIRE purist’s heart. Why? It doesn’t actually help you FIRE any earlier.

The tax benefit is just one side of things, but what good is it if you die before 60? Yes you may be may not care if you’re dead, but wouldn’t you prefer to be able to use it while you are in your prime?

The compounding effect is a valid argument. It would be ideal to contribute more during your early years such that it has a longer timeframe to compound. But how do you balance this with contributing towards your investible asset that would make up your FIRE number? Well…

If you feel like you’ve missed the boat when it comes to building up your retirement funds or you want a bit of flexibility from year to year, well have I got the perfect answer for you… Catch-up concessional contributions.

What is Catch-Up Concessional Contribution? This allows super fund members to use any of their unused concessional contributions cap/limit on a rolling basis for five years. The full amount will expire if it is not used five years later.

Wow, I did not even know of it’s existence! When did it start? This was only brought in from July 1 2018 in which individuals can start accumulating unused contributions and carry it forward. From July 1 2019, you can start paying extra to cover some or all the remainders. This is such an awesome rule change as it benefits people that have been out of a job or people returning to work after a period of parental / maternity / unemployment / carer’s leave etc. I love that this will help women close the gap further at retirement age as well other people with interrupted employment history..

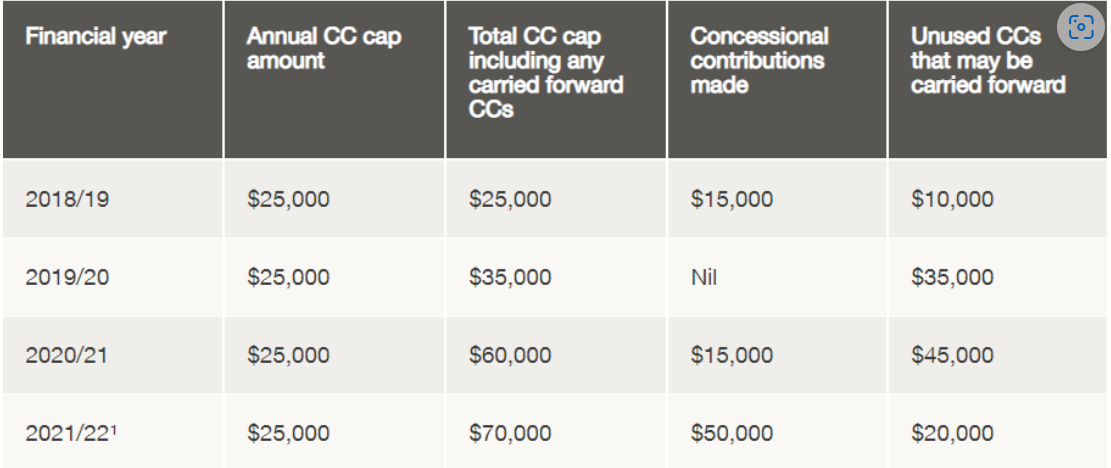

The Annual Cap $25k applies to concessional contributions from 2018/19 and $27.5k (recently indexed) from 1 July 2021.

Great! Can anyone do this? You would need to meet the following work test eligibility if you are aged 67 and over:

-

Complete a minimum of 40 hours paid work over a consecutive 30 day period (unless you meet the work test exemption). You cannot make voluntary concessional contributions once you are aged 75. The exemption applies to recent retirees aged between 67-74 with less than $300k at the most recent June 30th and can only be applied once in your lifetime.

-

Total super balance on the previous June 30 must be <$500k to be eligible for the catch up contribution. Sorry Captain FI ;) What a gun! Absolutely inspiring stuff, having >$500k before 30!

Example for illustration purposes In 2018/19 you are earning $100k and your employer pays 10% super which means $10k/$25k will be contributed that year. This $15k left over can paid any time within the next five years (2023/24).

This means in 2019/20 you can contribute up to $40k accounting for the concessional contribution of your $100k wage (assuming wage is unchanged and you still meet the work test). The $40k will only be taxed at 15% in the superannuation fund.

Cool. How this allow me to do both? What exactly are the possibilities? This gives you a degree of flexibility that you did not have prior to July 2018 as you lose what you didn’t use. For one reason or another you may not had wanted to contribute extra to super and focus on building up your FIRE number instead. Or you took the year off. Or you lost your job. Or you had a health issue. Or you did not have too much leftover after expenses. This allows you up to five years to contribute the remainder so you can choose to space out concessional contributions. For example. you did not want to contribute additional concessional contribution in year 1, then you contribute up to the cap in year 2 and 3 then no extra in year 4 and 5. This allows you to focus more on FIRE in year 1 and you don’t need to consider the tax benefits until 5 years after year 1 and year 4 respectively when you “pay off” the remainder unused amount. By the 9th year, you may be closing in on your FIRE target and can focus more on stockpiling your superannuation that you won’t be able to touch until 60 years old (as per current legislation).

This is just a illustration and obviously people may put in what they can in year 1 so they do not need to make up as much five years later or they contribute up to the cap every year. There is no hard and fast rule and everyone is at a different stage of life and thus, their FIRE journey.

See below for another example of the flexibility that this rule change allow:

You can let the unused concessional accumulate and “pay it off” in one go should you wish and have the funds rather than over a number of years.

Some tips on actioning all this

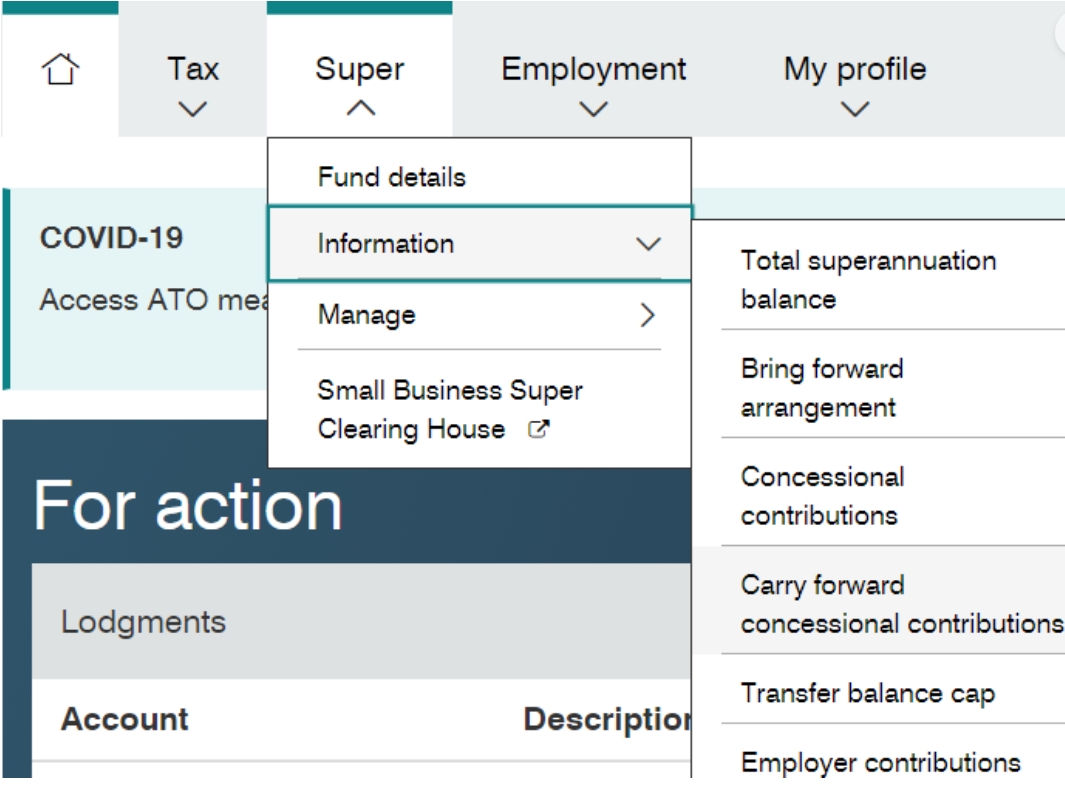

- Finding your Catch-Up Contribution Amount My accountant worked out that my catch up amount is ~30k and my partner is ~$35k. We also found out after that you can see the amount in the ATO section of myGov:

Super tab –> information –> Carry forward concessional contribution

Super tab –> information –> Carry forward concessional contribution

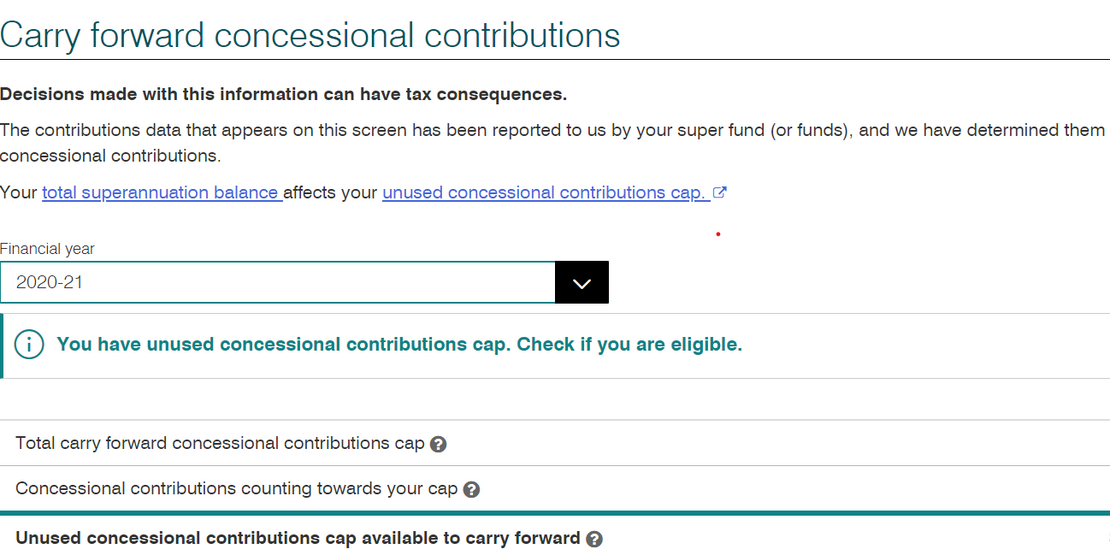

You should see the table above and voila the amount will be to the right of the screen (I removed mine). You can also choose to see the amount by FY (dropdown).

- How to get the Contribution Into your Super if you’re salary sacrificing your bonus Surprisingly there wasn’t a very clear way you can do this and there were potentially two ways. My Accountant advise me to get a form submitted from my super fund but I couldn’t get this done until the money has already been contributed.

I went to my company’s accounts to see if they can action it. Initially I was told that the salary sacrifice is still taxed going into it if you’re using Xero. Eventually we had to go to Xero to see what they can do and apparently bonus payments are taxed differently. If I had sacrificed my base salary it would had been fine but as it stood, our accounts team had to do manual adjustments. My accountant then told me that I won’t need to fill the form from my super if it’s been salary sacrificed. It was all so confusing for me. It turns out, that they initially confused after tax contributions with salary sacrifice.

In summary, if you are salary sacrificing, you don’t need to request a notice of intent form from your super fund.

I put this section here just in case anyone had the same issues. Please tell your accounts team to speak to Xero if they don’t know how to do the work-around that allows you to salary sacrifice your bonus. It might just be me though, coming from a start-up.

What are we planning to do with this info? I started working nearly a decade ago, so it’s a little annoying the accumulation date is from July 2018 and I missed out on several years of not maxing my concessional contribution. So this will benefit many people who have joined the workforce in recent years.

Working on our FIRE number has always been our number one priority. Given we are close to 50% of our FatFIRE target and about ten years off reaching this figure at our most conservative measure (realistically ~7 years), we decided to utilise this rule change to boost our super fund a little, especially in our current life stage.

Am I the only slow one here or did you all know of this rule change already? Please tell me what you’ve done with this cap flexibility or what you are planning to do if you haven’t anything? Would love to hear your thoughts in the comment below!

p.s. please read my disclaimer

You can also follow me for more personal finance tips.

FB

Insta

I’ve included my Linktree below for some useful links:

linktr.ee/thefirenanceguy

Enjoy what you are reading? Sign up for a better experience on Persumi.